Jazz Load Tax Calculator | Check Balance for Packages Subscription

Manage your Jazz mobile balance effortlessly with our Jazz Load Tax Calculator. This tool calculates the exact balance you’ll get after tax deductions on your recharge. Say goodbye to confusion! Enter your recharge amount, and instantly see the tax and final balance. Perfect for Jazz users in Pakistan planning their mobile load in 2025.

Jazz Balance Calculator 2025 | Check Load After Tax Deduction

Our Jazz Balance Calculator helps you stay in control. When recharging your Jazz balance, you will likely be subject to taxes. Advance income tax at 13.04% is applied to each recharge. For example, a Rs. 100 recharge gives you Rs. 86.96 in balance after a Rs. 13.04 tax deduction. Use the tool below to get precise results!

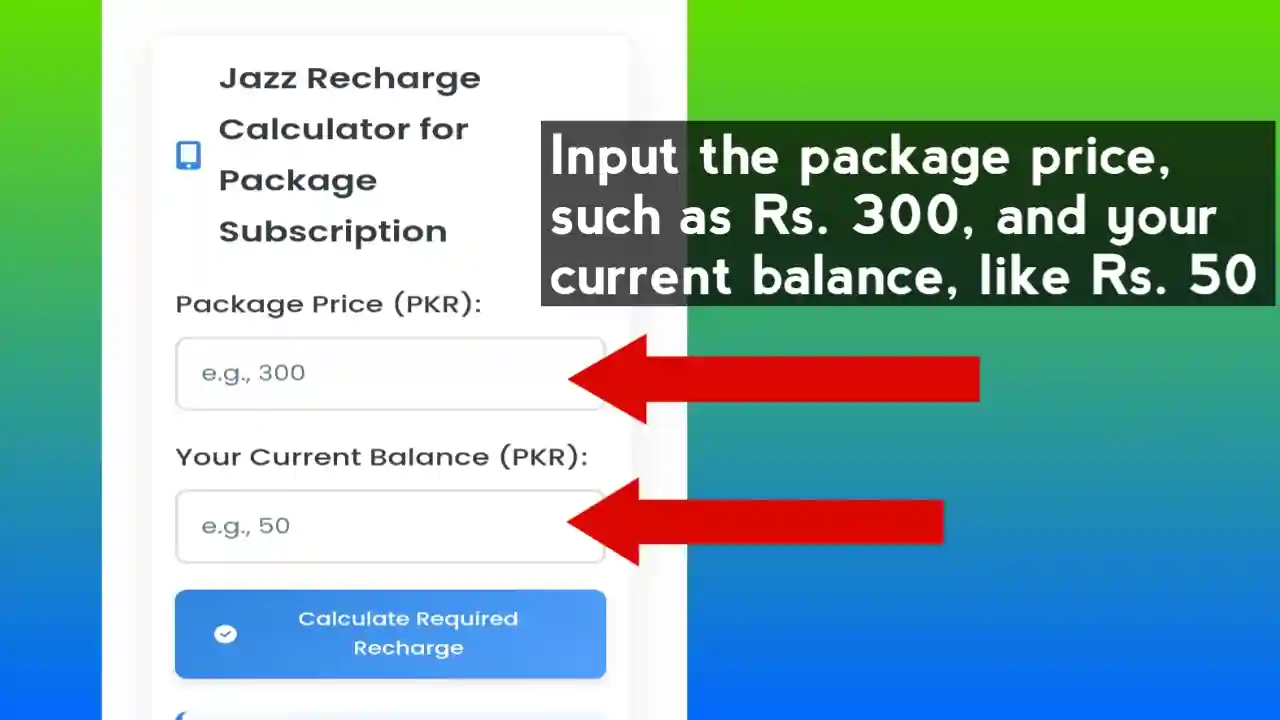

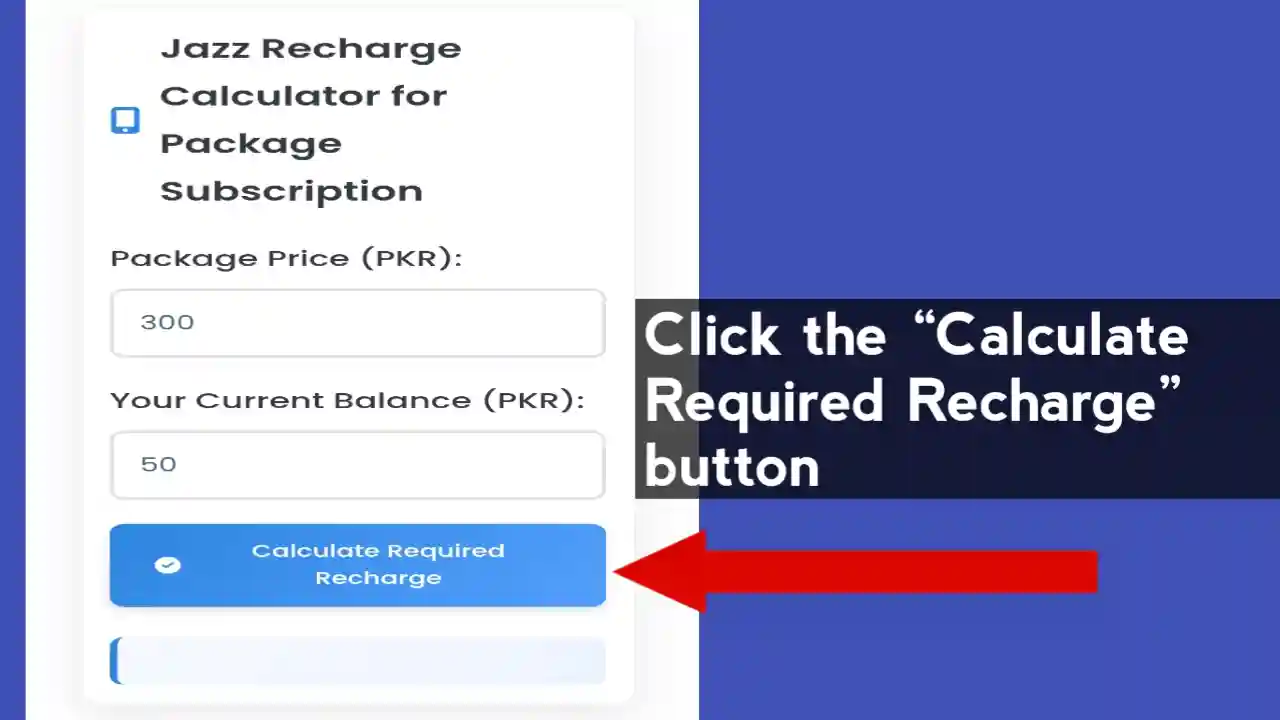

Jazz Recharge Calculator | Balance for Package Subscription

Planning to activate a Jazz package? Our Recharge Calculator simplifies the process. Enter your current balance and the package price, and we’ll calculate the exact recharge amount needed, including the 13.04% Advance Income Tax and the Rs. 10 always-have balance required by Jazz.

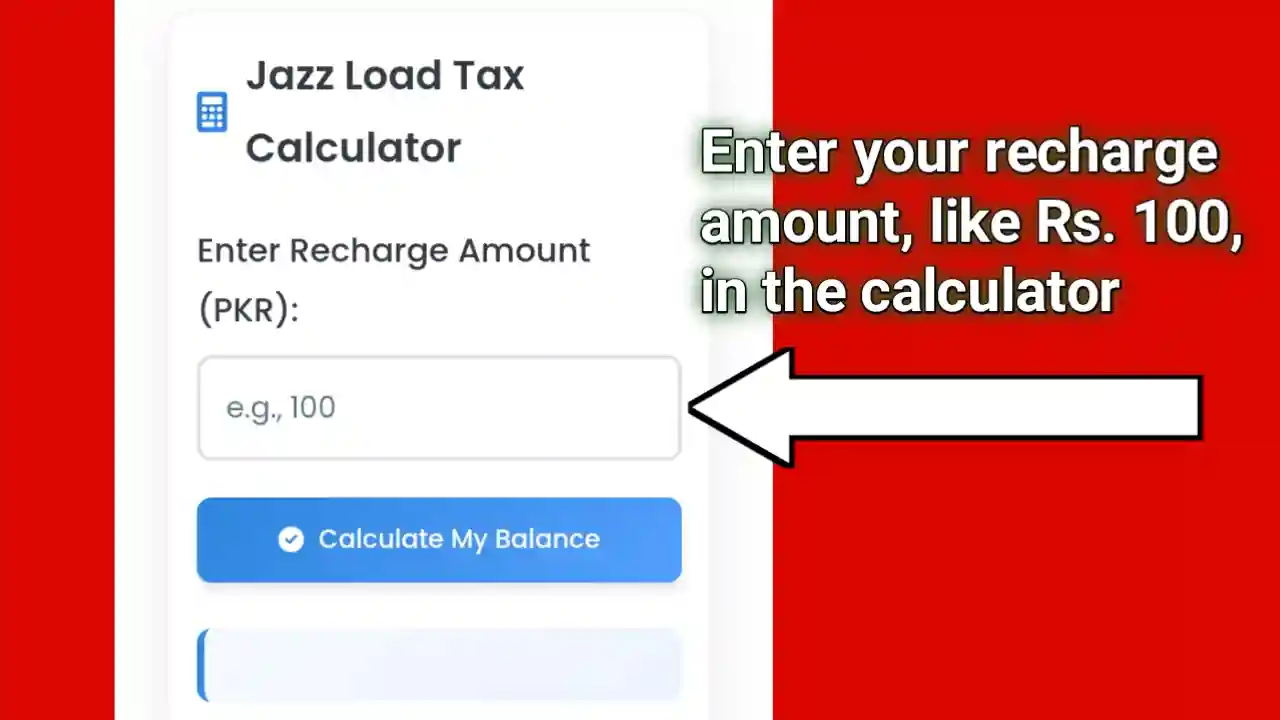

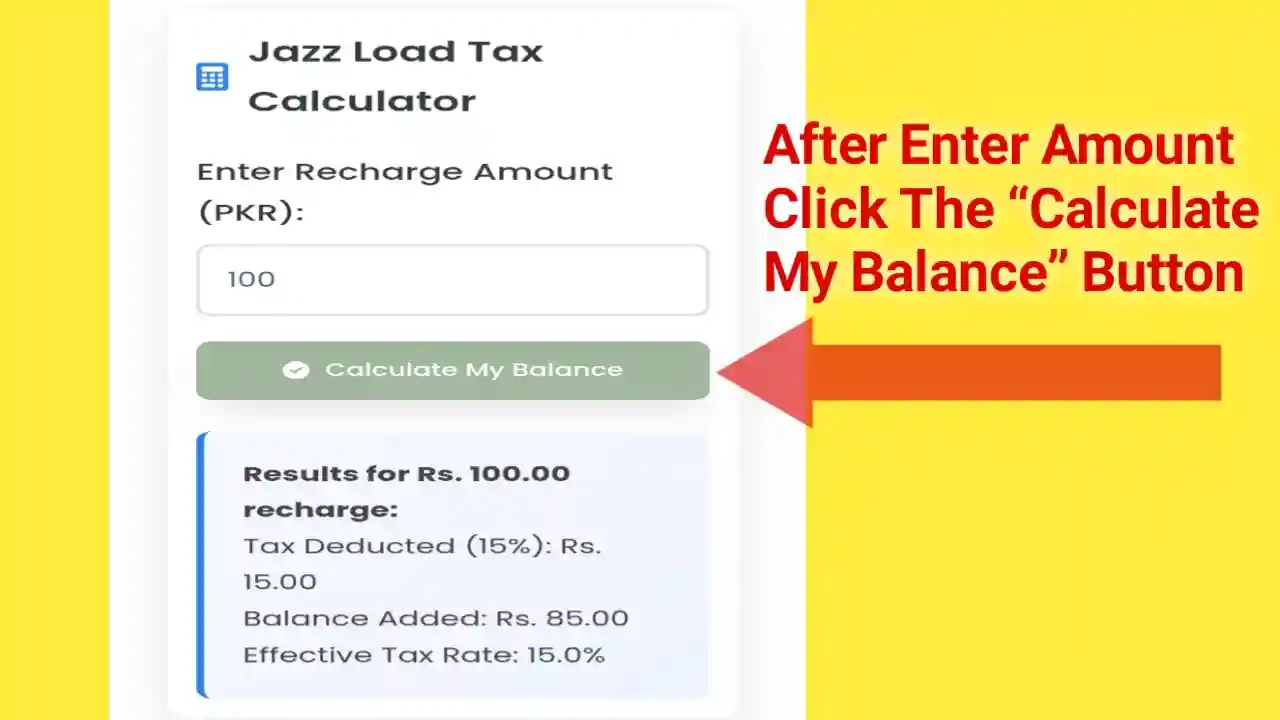

How to Use Jazz Load Tax Calculator

Our Jazz Load Tax Calculator and Recharge Calculator are user-friendly and quick. Follow these steps to manage your mobile balance effectively.

Example Use Case for Jazz Load Tax Calculator

- Enter your recharge amount, like Rs. 100, in the calculator

- Click the “Calculate My Balance” button

- View the tax deducted (Rs. 13.04) and final balance (Rs. 86.96)

Example Use Case for Jazz Recharge Calculator

- Input the package price, such as Rs. 300, and your current balance, like Rs. 50

- Click the “Calculate Required Recharge” button

- See the exact recharge amount needed

Details of Applicable Taxes in Pakistan

- When recharging your Jazz balance, you will likely be subject to taxes. Advance income tax at 13.04% is applied to each recharge.

- Rate of GST in Federal Territory of Islamabad is 19.5%.

- Rate of sales tax in rest of Pakistan and AJK is 19.5%.

- GB is exempted from taxes.

How Much Balance – Jazz (Updated 2025)

| Load Amount | Balance After Tax | Total Tax |

|---|---|---|

| Rs. 50/- | Rs. 43.48/- | Rs. 6.52/- (13.04%) |

| Rs. 100/- | Rs. 86.96/- | Rs. 13.04/- (13.04%) |

| Rs. 120/- | Rs. 104.35/- | Rs. 15.65/- (13.04%) |

| Rs. 150/- | Rs. 130.44/- | Rs. 19.56/- (13.04%) |

| Rs. 200/- | Rs. 173.92/- | Rs. 26.08/- (13.04%) |

| Rs. 250/- | Rs. 217.40/- | Rs. 32.60/- (13.04%) |

| Rs. 300/- | Rs. 260.88/- | Rs. 39.12/- (13.04%) |

| Rs. 400/- | Rs. 347.84/- | Rs. 52.16/- (13.04%) |

| Rs. 500/- | Rs. 434.80/- | Rs. 65.20/- (13.04%) |

| Rs. 600/- | Rs. 521.76/- | Rs. 78.24/- (13.04%) |

| Rs. 700/- | Rs. 608.72/- | Rs. 91.28/- (13.04%) |

| Rs. 800/- | Rs. 695.68/- | Rs. 104.32/- (13.04%) |

| Rs. 900/- | Rs. 782.64/- | Rs. 117.36/- (13.04%) |

| Rs. 1000/- | Rs. 869.60/- | Rs. 130.40/- (13.04%) |

What is Jazz Load Tax Calculator?

The Jazz Load Tax Calculator is a smart tool for Jazz users in Pakistan. It instantly calculates tax deductions on your recharge and shows your final balance. Enter your amount, and avoid surprises. This tool ensures you plan your mobile load efficiently.

Why Use This Tool?

- Get accurate tax and balance calculations for 2025

- Save time with instant results, no manual math needed

- Works for Jazz and other networks like Zong, Ufone, and Telenor

- Uses the latest PTA tax rates for trustworthy results

Benefits of Jazz Balance Calculator 2025

- Plan recharges to avoid running out of balance for packages

- Save money by preventing overcharges or extra deductions

- Stay connected without interruptions with exact recharge calculations

- Enjoy a simple, ad-free experience with clear results

Conclusion

Our Jazz Load Tax Calculator and Recharge Calculator are essential for Jazz users in Pakistan. They remove the hassle from mobile recharges by providing accurate tax, balance, and recharge calculations. Whether you’re activating a data, call, or SMS package, these tools ensure you load the right amount. Try them now and take charge of your mobile balance in 2025!

FAQs

How much tax is deducted on a Rs. 100 Jazz load?

On a Rs. 100 Jazz load, Rs. 13.04 is deducted as tax (13.04%), leaving you with Rs. 86.96 in balance.

What is the minimum balance required by Jazz?

Jazz requires a Rs. 10 “always-have” balance to keep services active.

How can I check my Jazz balance deductions?

Dial *111# to view your Jazz balance and check deductions.

How much balance do I get on a Rs. 500 Jazz load?

On a Rs. 500 Jazz load, you get Rs. 434.80 after a Rs. 65.20 tax deduction (13.04%).

Does this calculator work for other networks?

Yes, it supports Jazz, Zong, Ufone, Telenor, and other Pakistani networks.

Why is my balance less than the recharge amount?

The government deducts 13.04% Advance Income Tax on each recharge, reducing your balance.

Are tax rates the same for all networks?

Yes, all Pakistani networks follow the same PTA tax rates (13.04% AIT, 19.5% GST).

How do I calculate Jazz balance manually?

Multiply your recharge amount by 0.8696 to get the balance after a 13.04% tax deduction.

Is there any tax exemption in Pakistan?

Yes, Gilgit-Baltistan is exempt from recharge taxes.

Can I use this tool on my phone?

Absolutely! The tool is mobile-friendly and works perfectly on all devices.