Check tax for any mobile on passport and CNIC in Pakistan with our updated PTA Tax Calculator 2025. Our easy-to-use tool helps you quickly determine the exact tax amount for your smartphone.

PTA Tax Results

How to use PTA Tax Calculator?

Using our PTA Tax Calculator is simple and straightforward:

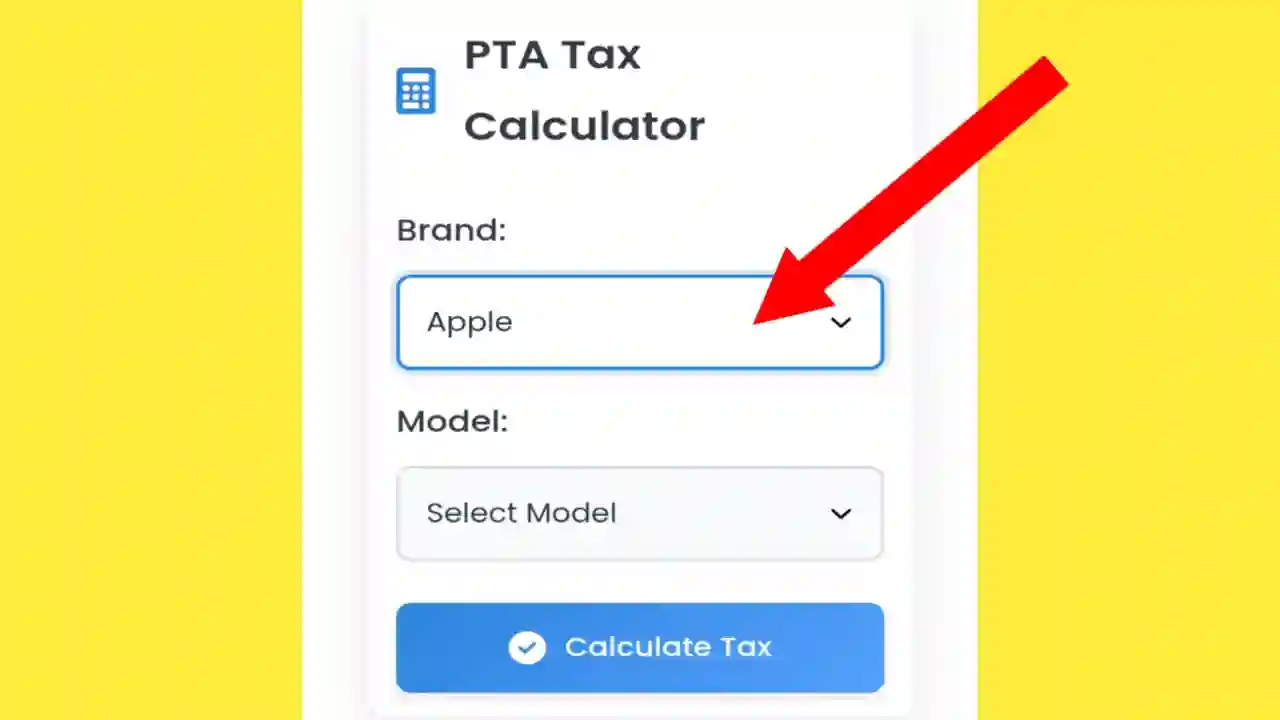

- Select Your Phone Brand: Start by selecting the brand of your mobile phone (Apple, Samsung, etc.)

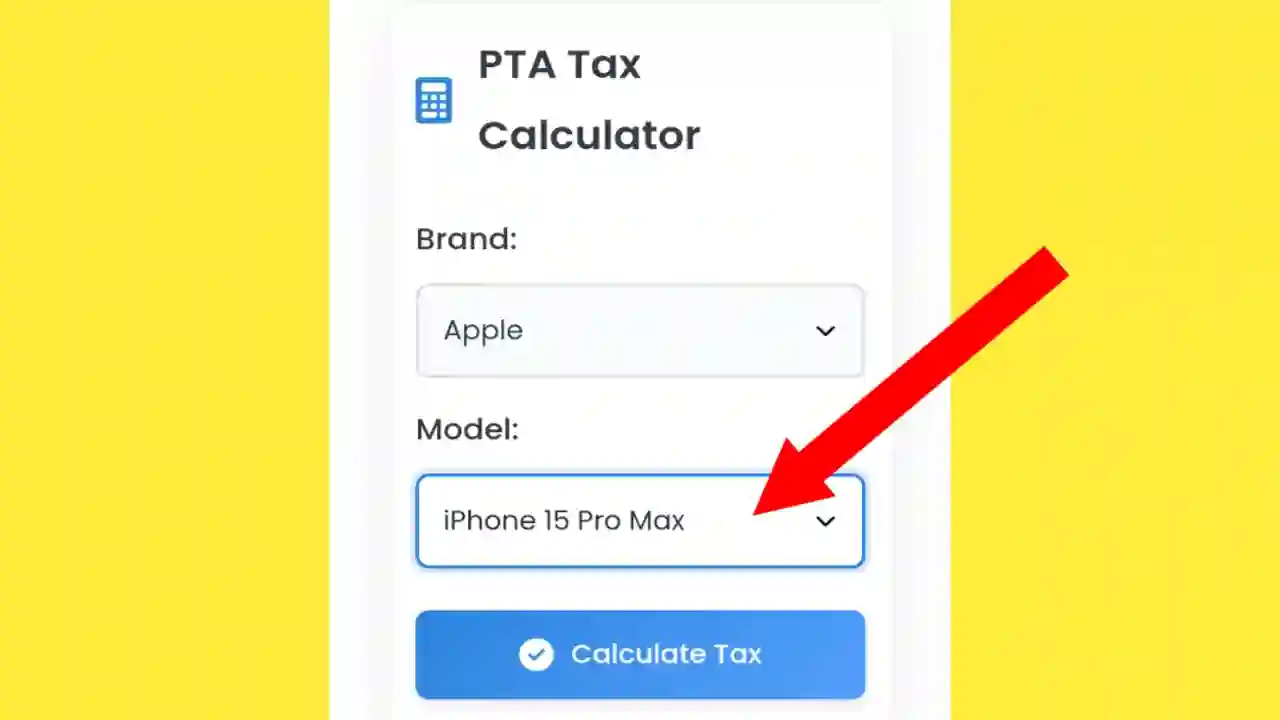

- Select Brand Model: After selecting your phone’s brand, choose the specific model (like iPhone 16 Pro Max)

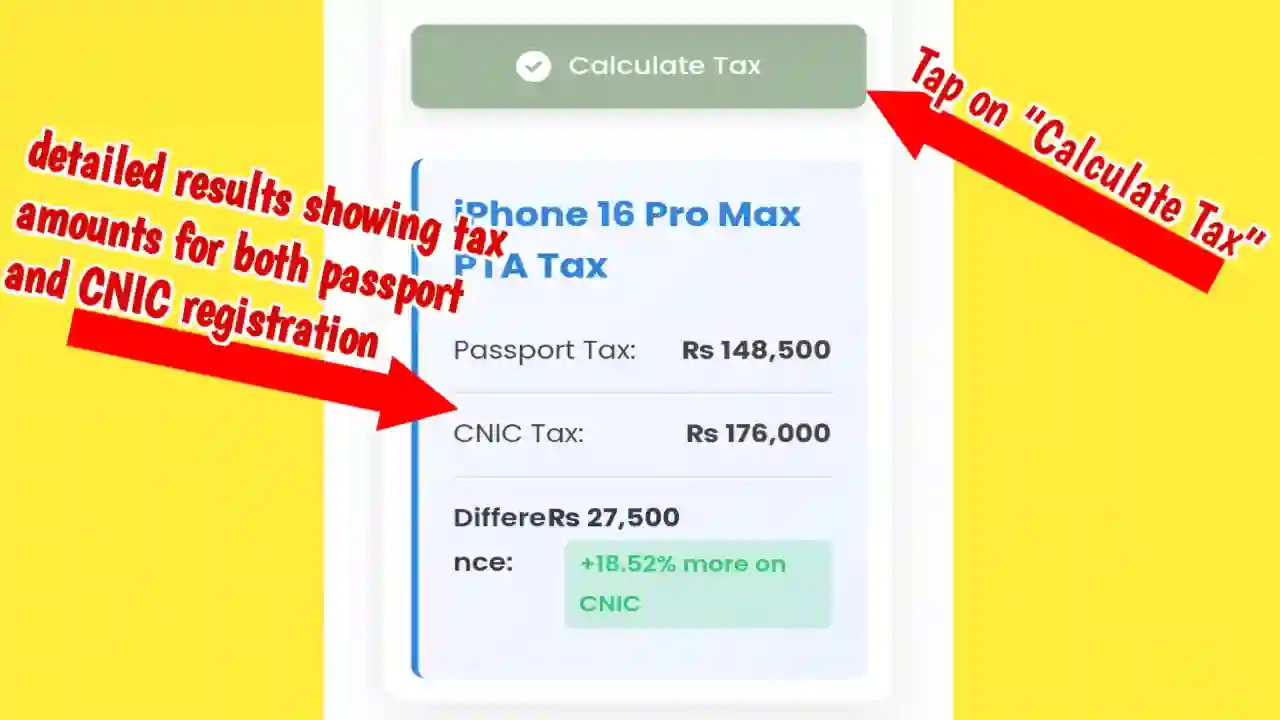

- View Results: Tap on “Calculate Tax” to get detailed results showing tax amounts for both passport and CNIC registration

Our calculator provides accurate tax information for all major mobile brands available in Pakistan, ensuring you know exactly how much you’ll need to pay.

What Is PTA Tax, and Why Does It Matter?

The PTA tax is a mandatory fee imposed on imported mobile phones to ensure compliance with Pakistan’s regulations. The tax amount depends on:

- Model: Newer and higher-end models have higher tax rates

- Registration Type: ATL (Active Taxpayers List) members enjoy lower rates, while non-ATL individuals pay double the tax

- Device Value: The more expensive your phone, the higher the tax

Understanding PTA tax is crucial because it affects anyone who imports or buys a smartphone from abroad. Whether you’re a traveler, an expat, or a local purchasing a foreign phone, knowing about PTA tax can save you from unexpected costs and potential fines.

Why Use This Tool?

Our PTA Tax Calculator offers several advantages:

- Up-to-Date Information: Always reflects the latest 2025 tax rates

- Dual Calculation: Shows tax amounts for both passport and CNIC registrations

- User-Friendly Interface: Simple design that anyone can use

- Completely Free: No hidden charges or registration required

- Accurate Results: Based on official PTA tax rates

How Much Tax for Your Mobile?

The tax you pay depends largely on the model and price of your mobile phone. Here’s a simple formula to help you understand how PTA tax is calculated:

Tax = (Price of Phone × Tax Rate) + (Customs Duty × (1 + Sales Tax Rate))

In this formula:

- Price of Phone: The price of your mobile phone

- Tax Rate: The tax rate applicable to your phone model (varies by model and brand)

- Customs Duty: A fixed amount charged on importing the phone

- Sales Tax Rate: The rate at which sales tax is applied (currently 17%)

Example Calculation

Let’s say you have a phone that costs PKR 50,000, with an applicable tax rate of 20%. The customs duty is PKR 5,000 and the sales tax rate is 17%.

Tax = (50,000 × 0.20) + (5,000 × (1 + 0.17))

Tax = 10,000 + (5,000 × 1.17)

Tax = 10,000 + 5,850

Tax = 15,850 PKR

So, the total PTA tax you’d pay is PKR 15,850.

Mobile Phone PTA TAX Rates on Passport

If you’re applying PTA tax with a passport within 60 days of arrival in Pakistan, here’s a breakdown of the tax you’ll pay based on your phone’s value in US dollars:

| Sr.No | Mobile Value in USD | PTA TAX in PKR |

|---|---|---|

| 1 | Up to $30 | 430 PKR |

| 2 | Above $30 and up to $100 | 3,200 PKR |

| 3 | Above $100 and up to $200 | 9,580 PKR |

| 4 | Above $200 and up to $350 | 12,200 PKR |

| 5 | Above $350 and up to $500 | 17,800 PKR |

| 6 | Above $500 | 27,600 PKR |

Note: 17% Sales Tax Ad Valorem is an extra amount in PKR that will be paid.

Mobile Phone PTA TAX Rates on CNIC

If you hold a CNIC, here’s a breakdown of the tax you’ll pay based on your phone’s value in US dollars for the year 2025, as officially shared by FBR for Pakistani users:

| Sr.No | Mobile Value in USD | PTA TAX in PKR |

|---|---|---|

| 1 | Up to $30 | 550 PKR |

| 2 | Above $30 and up to $100 | 4,323 PKR |

| 3 | Above $100 and up to $200 | 11,561 PKR |

| 4 | Above $200 and up to $350 | 14,661 PKR |

| 5 | Above $350 and up to $500 | 23,420 PKR |

| 6 | Above $500 | 37,007 PKR |

Note: 17% Sales Tax Ad Valorem is an extra amount in PKR that will be paid.

Importance of PTA Tax

The PTA tax holds significant importance in Pakistan’s fiscal landscape for several reasons:

- Fair Contribution to State Resources: Ensures that everyone who owns a mobile device in Pakistan contributes fairly to the nation’s resources, distributing the tax burden equitably among all users.

- Industry Regulation: Taxing imported mobile phones helps maintain a balance between demand and supply within the local mobile phone market, preventing market saturation.

- Economic Growth: The revenue generated from PTA taxes contributes to the country’s economic growth, allowing investment in various sectors.

- Support for Mobile Communication Networks: Funds collected provide financial support necessary for the governance and maintenance of Pakistan’s mobile communication networks like Jazz, Zong, Ufone, and Telenor.

- Equitable Tax Burden: The PTA tax system ensures that the tax burden is shared fairly among different income groups, preventing any single group from being disproportionately affected.

How this PTA Tax calculator works?

If you’re using an imported mobile phone in Pakistan, it must be PTA approved, or your mobile will be blocked by PTA within 60 days. To make your mobile PTA approved, you need to check and pay the tax on your device.

Here’s a simple example of how to check tax on an iPhone:

- To check PTA tax on an iPhone 7 Plus, first select “Apple” as the brand

- Then select “iPhone 7 Plus” as the model

- Press the “Calculate Tax” button to see the results

- The calculator will show that PTA tax on iPhone 7 Plus with CNIC is RS 65,280 and with passport is 64,036

You can check PTA tax for any mobile phone using this same simple process.

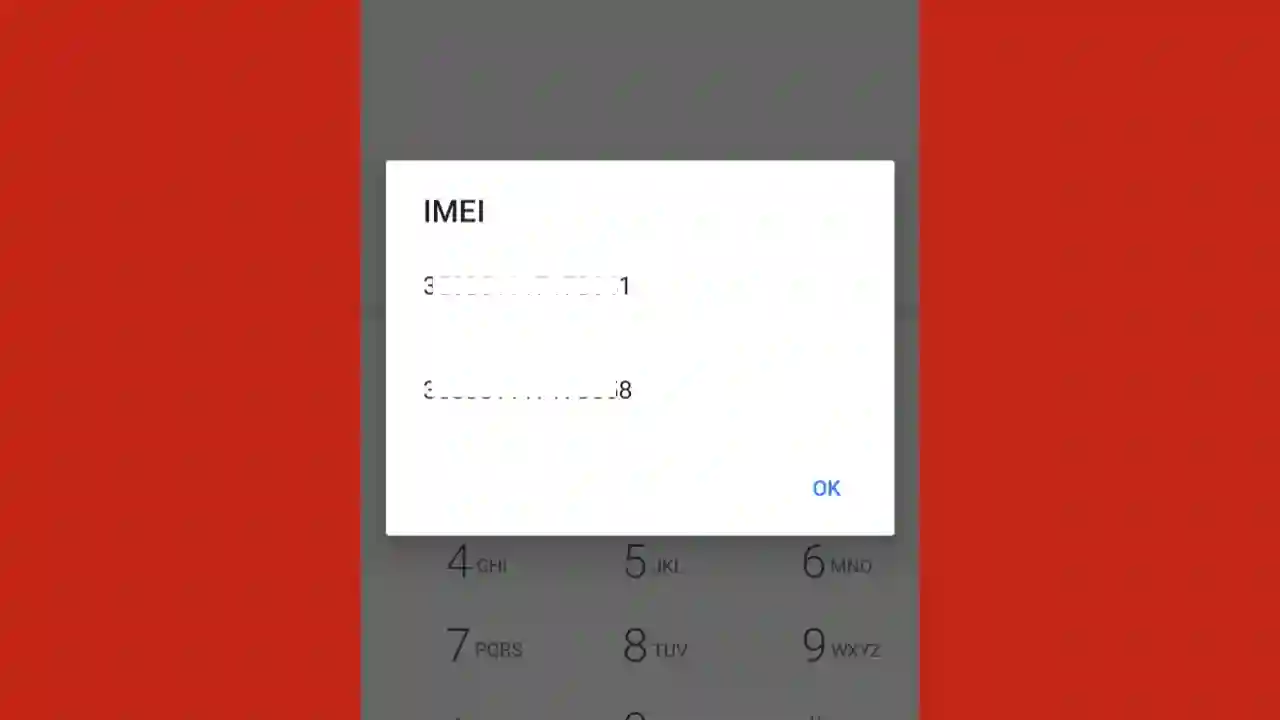

How to Check PTA Tax by IMEI Number?

Another way to check PTA tax is by using your device’s IMEI number. Follow these steps:

- Insert SIM Card: Make sure you have a SIM card inserted into your mobile device

- Dial Code *8484#: Open your phone’s dialer and dial *8484#

- Enter Mobile Number: You’ll be prompted to enter your mobile number

- Enter CNIC: Next, enter your CNIC (Computerized National Identity Card) number

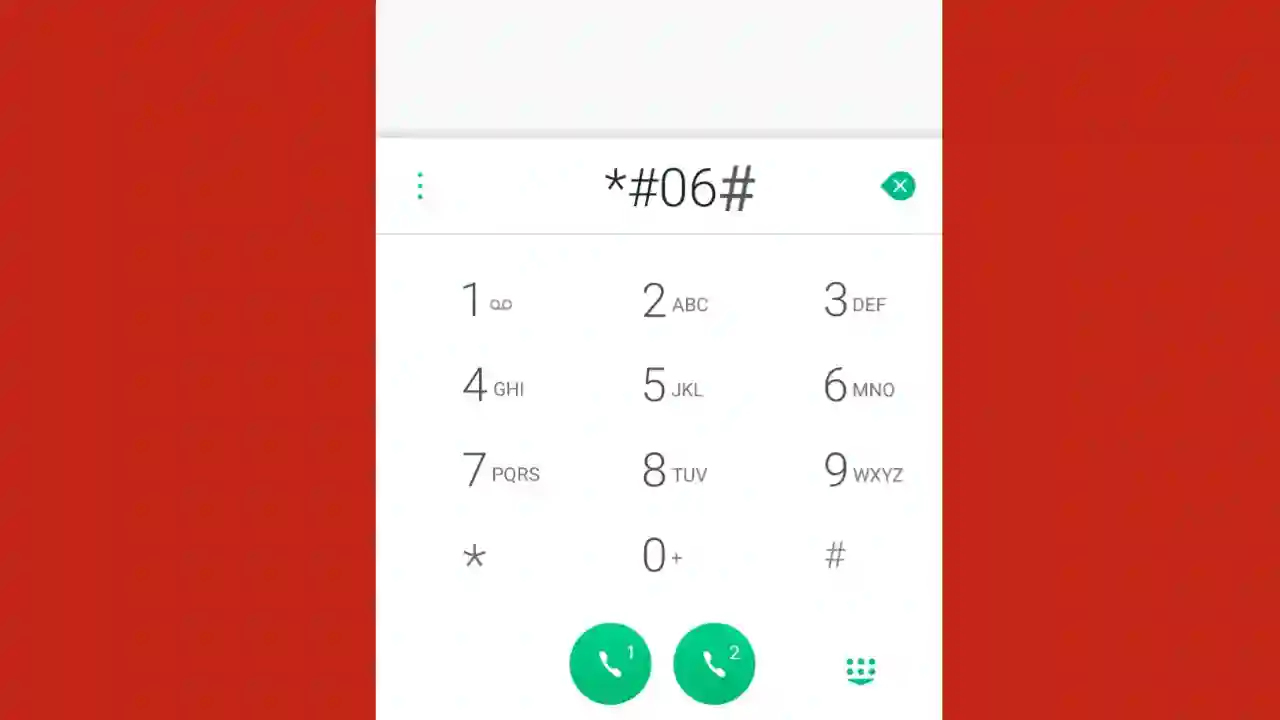

- Enter IMEI Number: Now, enter your mobile phone’s IMEI number (dial *#06# to find it)

- Click OK: Once you’ve entered all required information, click OK or send

- View PTA Tax Amount: After a few moments, you’ll receive a message showing the PTA tax amount payable

To register your mobile device, follow the instructions provided in the message to send the required amount online to the account number provided by PTA.

PTA approve status check online

You can check your mobile’s PTA approval status online by:

- Visiting the official DIRBS website (PTA DIRBS Status Check Portal)

- Entering your device’s IMEI number in the search box

- Clicking on “Check” to see your device’s current status

This verification helps you confirm whether your device is already registered or needs to be approved by PTA.

How to Pay PTA Mobile Registration Taxes Online?

Paying your PTA mobile registration taxes online is now easier than ever. Here’s a step-by-step guide:

- Create Account on DIRBS Website:

- Head to the PTA mobile registration portal and register

- Select your user type (personal or commercial)

- Submit your information and verify your email

- Apply for Certificate of Compliance (COC):

- Log in and find “Individual COC” under “Dashboard”

- Choose “Apply for COC” and select the appropriate option

- Provide your passport number or phone number and operator’s name

- Provide IMEI Number(s):

- Enter your device’s IMEI number(s)

- Ensure all SIM slots are covered if you have a dual-SIM phone

- Generate Payment Slip Identity (PSID):

- The system will generate a PSID for payment

- Pay PTA Mobile Tax Online:

- Pay via direct bank transfer, mobile wallets, or at bank branches

- Complete the payment process using your preferred method

After payment, your device will be registered and compliant with PTA regulations.

How I Pay PTA Tax For Your Mobile? – Personal Experience

I recently had to pay PTA tax for my new phone, and I thought I’d share my experience to help others.

Initially, I tried paying through Bank Alfalah since I knew someone with an account there. They’ve been reliable – I’ve even helped friends with their payments online through this method.

I also tried Allied Bank. You need to visit a major branch and speak with their Relationship Manager (RM). They’ll provide a deposit voucher and guide you through the filling process. I successfully used this method a few months ago for my iPhone 12.

However, I learned that online payments have been suspended since July 2015 due to fraud concerns. Now, you must visit your bank in person to complete the payment. It’s slightly inconvenient but ensures legitimacy and prompt confirmation from PTA.

For PTA office locations, you can check online guides that list offices in all Pakistani cities. Many Reddit users also share helpful advice about navigating PTA-related issues.

Our PTA Calculator for All Mobile Phone Brands in Pakistan

Our PTA calculator tool makes checking your mobile’s duty simple and works for all major phone brands in Pakistan:

iPhone PTA Tax:

Whether you have the latest iPhone 16 or an older model like iPhone 12, our tool calculates the exact tax for each iPhone model based on current rates.

Samsung Galaxy Phones PTA Tax:

From the newest Galaxy S23 to the sleek Z Fold5, our calculator determines the precise tax based on each Samsung phone’s value.

Google Pixel Phones PTA Tax:

Known for their exceptional cameras and clean software, Google Pixel phones also require PTA tax. Our calculator includes all Pixel models, making tax calculation simple.

Xiaomi/Redmi Phones PTA Tax:

Popular for their excellent value, Xiaomi and Redmi phones need PTA registration too. Our calculator provides accurate tax information for all models.

Realme Phones PTA Tax:

Growing rapidly in Pakistan’s market, Realme phones require proper PTA tax payment. Our tool helps you calculate the exact amount for any Realme device.

OnePlus Phones PTA Tax:

For OnePlus enthusiasts, knowing the PTA tax is essential. Our calculator covers all OnePlus models, including the latest OnePlus 11 and 12 series.

Infinix Phones PTA Tax:

Budget-friendly Infinix phones are subject to PTA tax as well. Our calculator provides precise tax calculations for all Infinix models.

Motorola Phones PTA Tax:

The classic Motorola brand still requires PTA tax in Pakistan. Our tool calculates the exact amount for all Motorola models.

Sony Phones PTA Tax:

Premium Sony Xperia devices need proper PTA registration. Our calculator helps determine the correct tax amount for these high-end phones.

Huawei Phones PTA Tax:

Despite recent changes, Huawei phones remain popular and require PTA tax. Our calculator provides accurate information for all Huawei models.

Tecno Phones PTA Tax:

Budget-conscious users love Tecno phones, which still need PTA approval. Our calculator offers precise tax calculations for all Tecno devices.

Nokia Phones PTA Tax:

The revived Nokia brand produces quality phones that require PTA registration. Our tool calculates the exact tax for any Nokia model.

Oppo Phones PTA Tax:

Oppo phones, known for their camera capabilities, require PTA tax. Our calculator covers all Oppo models, including the stylish Reno and budget-friendly A series.

Vivo Phones PTA Tax:

Popular Vivo phones need proper registration with PTA. Our calculator provides accurate tax information for all Vivo models, including the V and Y series.

Benefits of Being an ATL Member

If you’re listed on the Active Taxpayers List (ATL), you’ll enjoy significant advantages:

- Lower Tax Rates: Substantially reduced PTA taxes compared to non-ATL members

- Faster Approvals: Easier and quicker device registration process

- Cost Savings: Pay approximately half the tax amount that non-ATL members pay

Pro Tip: Non-ATL members face 100% higher tax rates. Joining the ATL is highly recommended to save costs on mobile phone registration.

How to Check Mobile IMEI Number

To determine whether your phone IMEI is PTA approved:

- Dial the Code: Open your phone’s dialer and type *#06# to instantly display the IMEI

- For Dual SIM Phones: You’ll see two IMEI numbers—note both for verification

This simple step is crucial for your IMEI PTA approved check online and registration process.

Methods to Verify Your Device’s Compliance Status

PTA IMEI Check Online status by SMS:

- Compose a new text message by typing your IMEI number

- Send it to 8484

- Within a minute, you’ll receive a notification displaying whether your device is compliant, non-compliant, or blocked

PTA approved check online by IMEI:

- Visit the DIRBS official website

- Enter your IMEI number in the required field

- Click on the “Check” button to view your device’s status

Disclaimer

We strive to keep the PTA tax rates for different mobile brands and models updated. However, please note that the rates mentioned may not always be 100% accurate due to fluctuations in the dollar rate and inflation, which can affect mobile prices and taxes. Additionally, the PTA frequently updates the tax rates in Pakistan.

Our aim is to provide users with an average estimate based on the latest information available at the time. For the most current tax cost, please dial *8484# or visit the PTA DIRBS Portal.

Note: This website is not affiliated with, endorsed by, or associated with any government entity. It provides general information based on publicly available sources.

Conclusion

Our PTA Tax Calculator is the most comprehensive tool available for checking mobile phone taxes in Pakistan for 2025. Whether you have an iPhone, Samsung, or any other brand, our calculator provides accurate tax estimates for both passport and CNIC registration methods. Remember to PTA approve your device within 60 days of arrival to avoid service disruption. For the most accurate results, use our calculator or dial *8484# from your mobile.

Frequently Asked Questions (FAQs)

How is mobile PTA tax calculated?

PTA tax is calculated based on the value of your mobile phone, with different rates applying to different price brackets. The calculation also takes into account whether you’re registering with a passport or CNIC.

How do I check my mobile PTA tax?

You can check your mobile PTA tax by using our calculator, sending your IMEI number to 8484 via SMS, or checking on the official DIRBS website.

Is PTA tax free for 120 days?

No, it’s for 60 days. After arriving in Pakistan, you have 60 days to register your phone before it gets blocked.

How much is PTA tax on iPhone 13?

The exact amount varies based on the model (Pro, Pro Max, etc.) and whether you’re using a passport or CNIC for registration. Use our calculator for the most accurate figure.

How do I check my PTA approved mobile?

Dial *#06# to get your IMEI number, then send it to 8484 via SMS or check on the DIRBS website.

What is the price of iPhone 12 PTA tax approved in Pakistan?

The PTA tax for iPhone 12 varies by model. Use our calculator for the most current rates based on your specific model.

How do I verify PTA 8484?

Send your IMEI number via SMS to 8484, and you’ll receive a verification message about your device’s status.

Is PTA tax reduced?

PTA tax rates can change based on government policies. Our calculator always reflects the most current rates available.

How to pay for PTA tax?

You can pay PTA tax through bank transfers, in-person at bank branches, or sometimes through mobile wallets (though online payments have been limited since 2015).

How to check an IMEI number?

Dial *#06# on your phone to display your IMEI number.

How many phones are allowed on an international flight to Pakistan?

Travelers are typically allowed to bring one phone duty-free. Additional phones will require PTA tax payment.

Can I pay PTA tax through EasyPaisa?

While EasyPaisa was previously an option, recent changes have limited online payment methods. It’s best to check with your bank for current payment options.

How to pay PSID online?

You’ll need to visit a bank branch in person to pay your PSID due to recent changes in online payment policies.

How to PTA approve iPhone?

Follow the standard PTA approval process: check IMEI, register on DIRBS, generate PSID, and pay the required tax at a bank.

How much PTA tax on iPhone 14?

The tax varies by model (base, Plus, Pro, Pro Max). Use our calculator for the most accurate, up-to-date rates.

How can I check my PTA tracking ID?

You can check your tracking ID status on the DIRBS website by logging into your account.

How do I block my stolen phone with PTA?

Report your stolen phone to the police, then visit a PTA Customer Service Center with your police report and device documentation to block the IMEI.

What is the PSID for PTA tax?

The Payment Slip ID (PSID) is a unique identifier generated when you register your device on the DIRBS portal. You’ll use this ID when paying your PTA tax.

What is the PTA tax for A73 5G in Pakistan?

Use our calculator to get the most accurate and current tax rate for the Samsung Galaxy A73 5G.

How much is PTA tax on Nothing Phone 1?

For the exact PTA tax on the Nothing Phone 1, use our calculator to get the most up-to-date rate based on its value category.